Summary

- ChatGPT can help create basic budget templates but may struggle with complex calculations and insights.

- It lacks real-time integration with financial accounts and risks privacy concerns when handling sensitive data.

- Despite limitations, ChatGPT can offer insights, savings plans, and spending trends through plain English prompts.

ChatGPT has many amazing features, but did you know you can use it as a personal budgeting tool? My ChatGPT personal budgeting tool has income tracking, savings plans, and spending insights—but also highlights some of the limitations of using AI.

How I Prompted ChatGPT to Create a Budget Template

ChatGPT is renowned for its versatility. However, there is undoubtedly a comfort zone where it performs at its best. It’s fair to say that getting it to manage my household budget is probably stretching its limits. But can it do it?

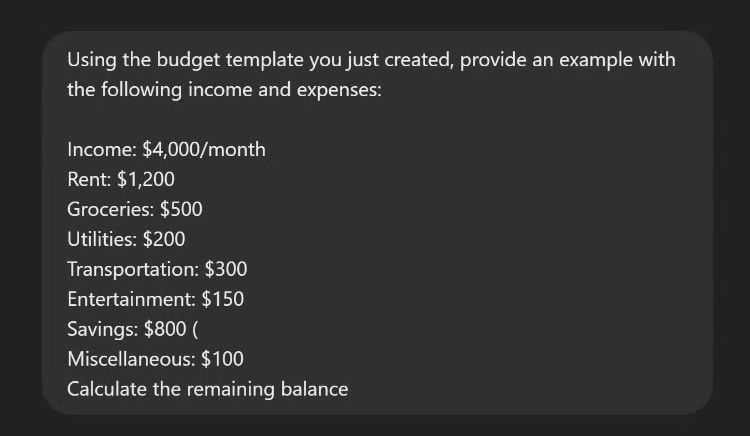

Of course, it can, but whether ChatGPT can produce a workable and practical budget template is a different matter—and one that I’m going to put to the test. To begin with, I opened a new chat and entered the following prompt:

So far, so good. We now have a ChatGPT-produced table to use as the basis for my budget tool. At this point, I made a minor tweak to change the currency to USD, which I completed with a simple prompt. Aside from this, I decided to move on with its suggested table and test it by adding some data. The prompt I used was:

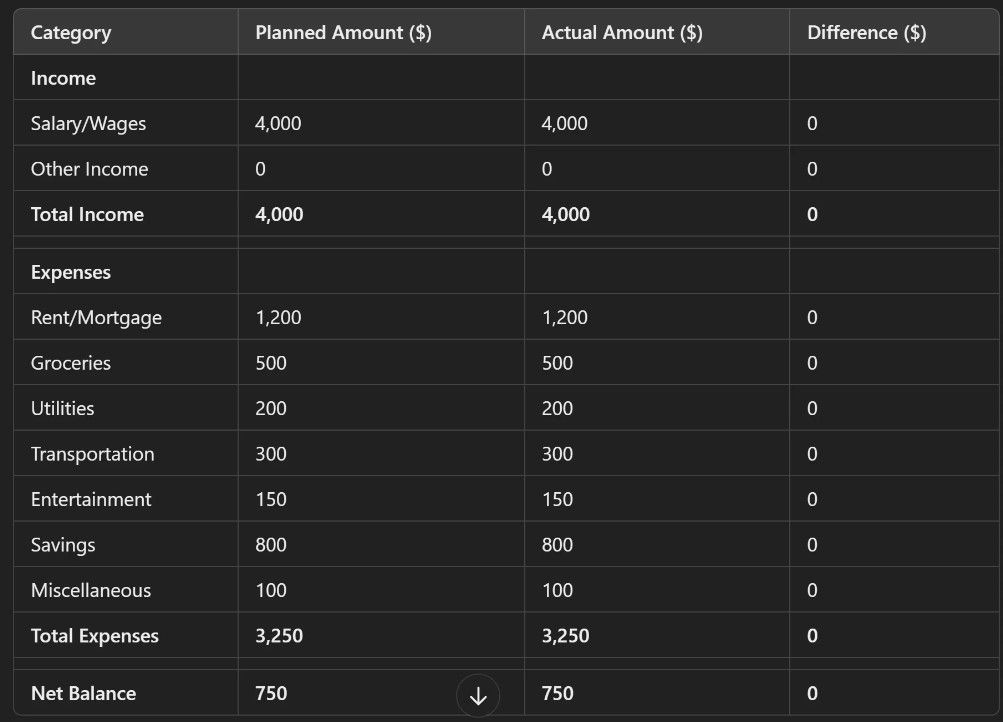

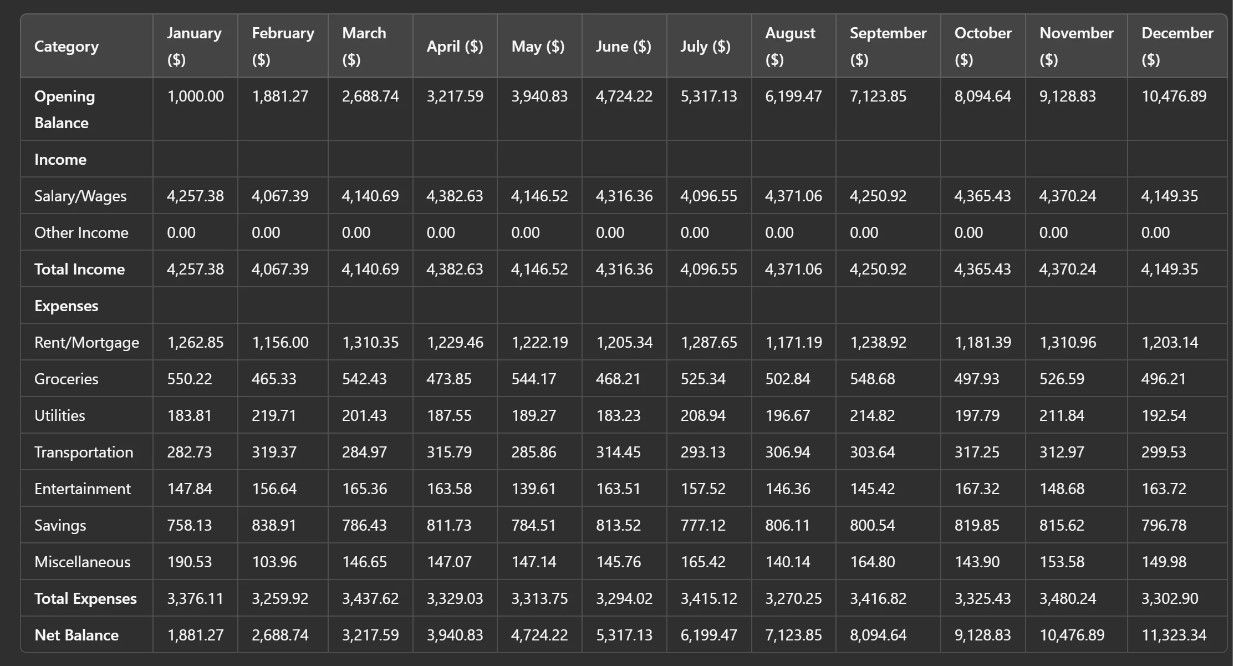

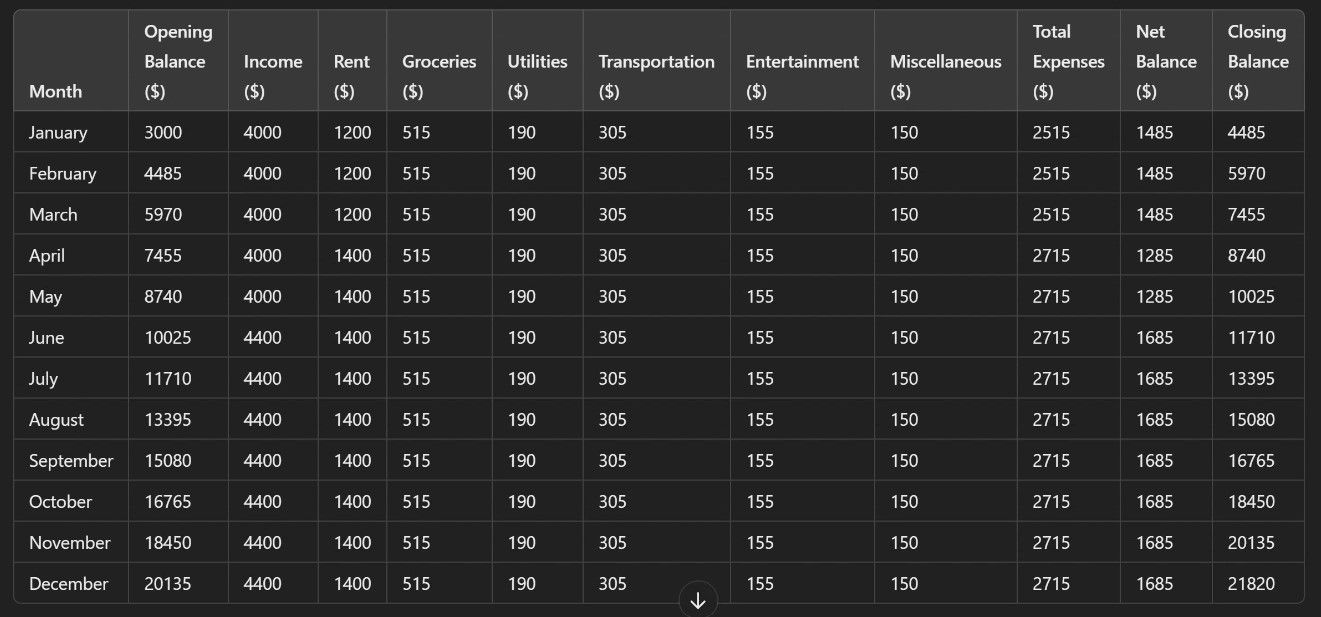

ChatGPT then populated the table with the data:

This is a good first step, but it’s incredibly limited and—at this point—no more functional than a basic spreadsheet. More work is needed if I get some AI-powered benefits from this.

Refining My ChatGPT Budget Template

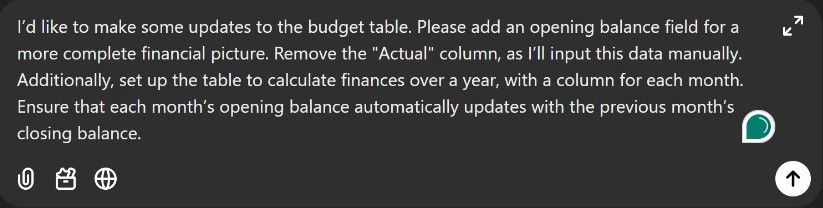

I decided that a planned and actual column wasn’t required—or even asked for—and that a column for each month would be more useful. I also decided that having a starting balance would be useful rather than letting ChatGPT assume a $0.00 start.

To achieve this, I entered the following prompt:

I also asked it to populate the January column with a $1,000 opening balance and the data from the first iteration. ChatGPT generated the following table.

It’s now shaping up more like what I need. However, it’s still no more than could be achieved with a basic spreadsheet. For this project to work, we must explore how ChatGPT’s AI capabilities can surpass simple calculations.

To test the system fully, I told ChatGPT to populate the entire table with data. I asked it to use the January data as the base reference but to vary each month’s data slightly and by no more than 10%. This gave me a random dataset that I could start experimenting with.

The table now looked like this:

Armed with a fully populated data set, I could now explore some advanced prompts. With these, the goal is to see whether I could elevate its functionality from a glorified spreadsheet to an AI-inspired budgeting tool.

Can It Identify Spending Trends?

One way the AI aspect could be useful is to ask it to identify spending trends. While this is possible with a spreadsheet, the capability to ask relevant questions in plain English is where ChatGPT should come into its own.

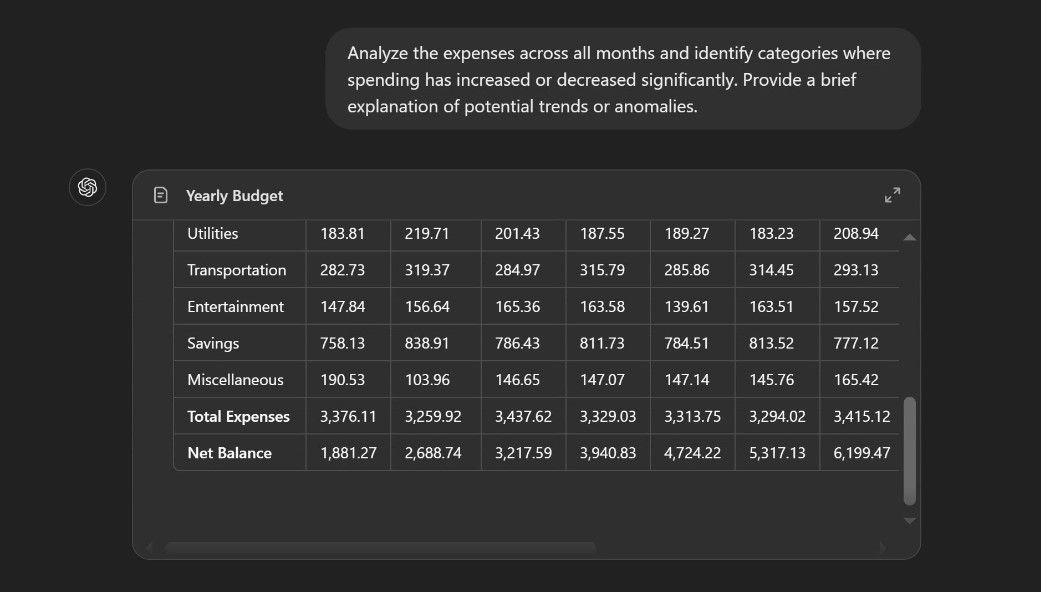

I tested this with the following prompts:

The result was quite impressive; ChatGPT identified some trends within the data and generated a list of spending trends. The limiting factor here was the data I used. There is very little variation in each field. However, the ability to address such questions begins to illustrate the difference between this and a simple data table.

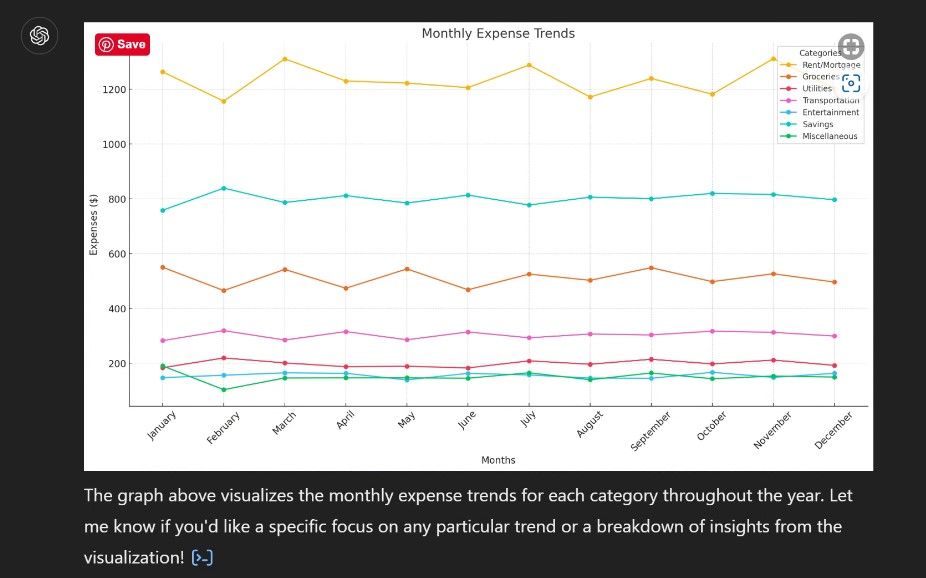

Next, I asked ChatGPT to create a graph of my spending trends:

The graph demonstrates the model’s ability to provide data visualization in response to a natural language prompt.

Using ChatGPT to Set Savings Goals

The next task I tried was to ask ChatGPT to help me create a savings plan. Again, the ability to do this in plain English helps differentiate it from a plain data table.

The prompt I used was:

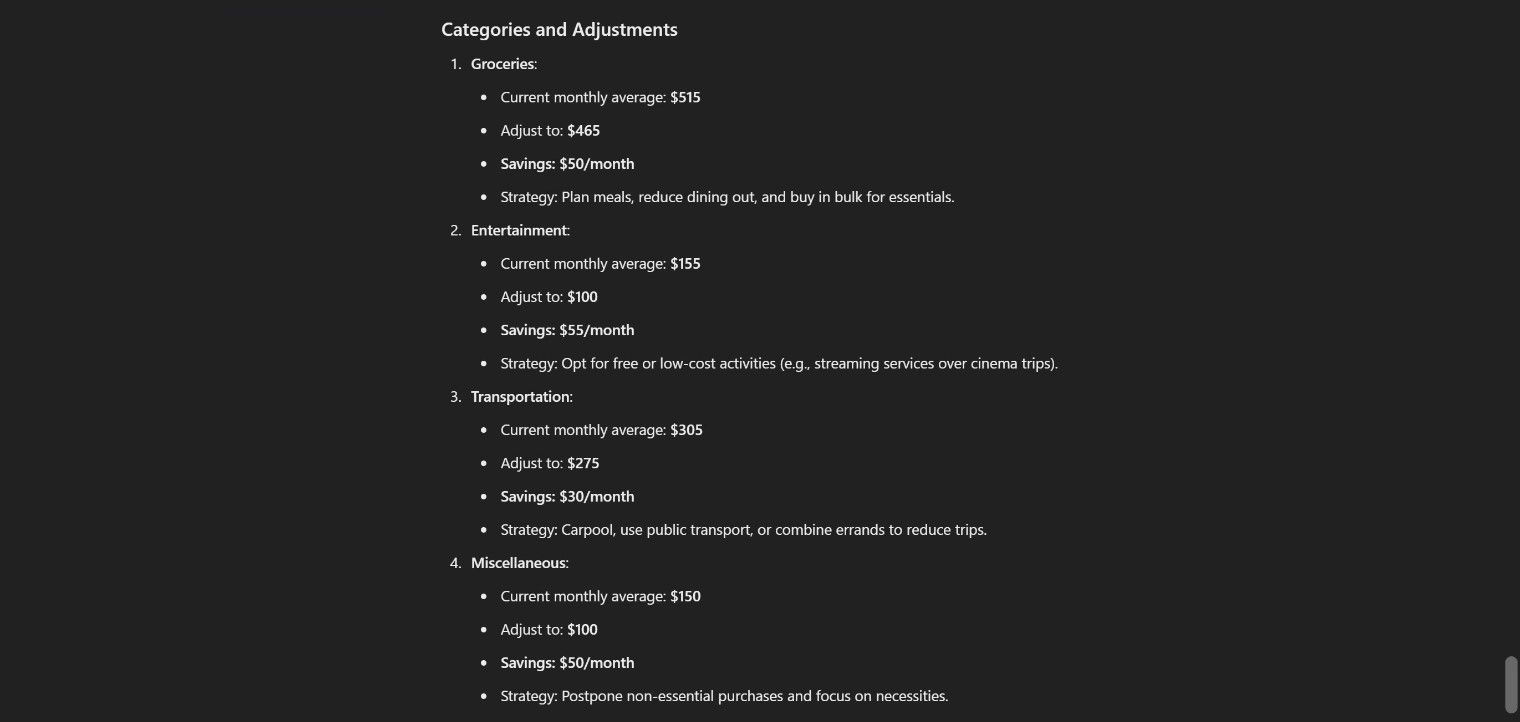

I have to say that I was impressed with the result again. Not only did ChatGPT come up with a savings plan, but it also suggested strategies to help achieve the desired results.

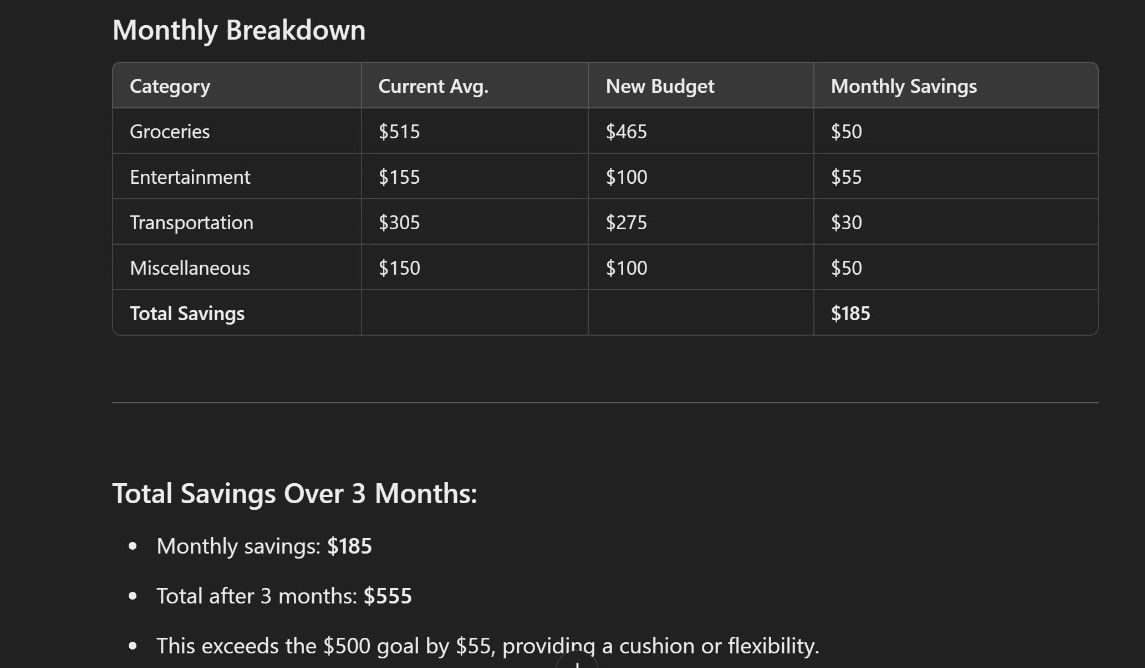

It also added a table that summarized its recommendations:

The ChatGPT response to this query was excellent. The bare figures alone showed how the savings could be achieved, but the recommendations about how to achieve them elevate ChatGPT’s response beyond mere data manipulation.

Scenario-Based Planning Using ChatGPT

In this test, I asked ChatGPT to simulate a scenario where I changed some of the values of the supplied data. The prompt I used was:

The results were a mixed bag this time. Partially, this is due to the vagueness of the prompt. ChatGPT responded with basic text explaining how the changes would impact the finances and a table showing this. However, the table was missing an opening and closing balance and was of limited use. To adjust the result, I used the following prompt:

The table below shows how ChatGPT responded:

It took a couple of prompts to get the desired result. This shows the importance of well-considered prompts but also highlights an inherent clumsiness that needed a little creativity to negotiate.

While the results were promising, there are definite downsides and limitations. From some practical limitations to privacy concerns, ChatGPT has considerable disadvantages as a budgeting tool.

- No real-time integration with financial accounts: ChatGPT cannot link directly to your bank accounts or credit cards, meaning you must manually input all data. This can be time-consuming and increases the chance of errors.

- Limited context retention: I had no issues with this. However, experience tells me that ChatGPT can lose track of previous prompts. This is especially relevant if the conversation gets too lengthy.

- Potential for calculation errors: ChatGPT can perform calculations but is not immune to errors.

- Privacy and security concerns: Your financial data must be shared with ChatGPT, which raises privacy concerns. OpenAI’s servers process this information, so avoiding sharing sensitive or personally identifiable details is essential. This is an unavoidable issue if you want your budget to be useful.

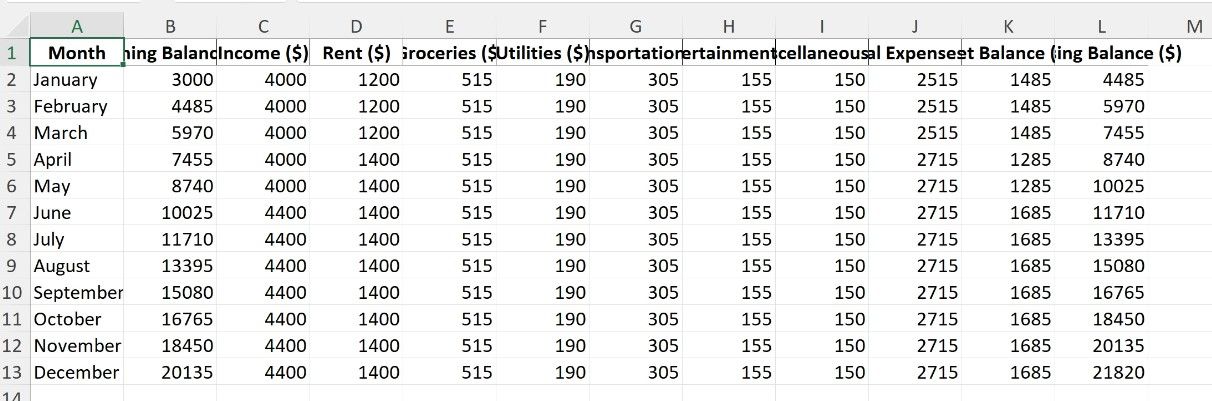

For at least some of these downsides, exporting the data as a spreadsheet can be useful. It gives you a current set of data you can use to work around the limited context issue, but it also allows you to easily verify calculations.

To achieve this, I asked ChatGPT to export the table as a spreadsheet, and I could download a spreadsheet version.

There are some obvious limitations to using ChatGPT as a budgeting tool, but it was a valuable and interesting experiment. With a few simple prompts, I was able to build a functional finance tool. While it may not replace dedicated budgeting apps, it demonstrates how AI tools can adapt to everyday tasks in unexpected ways.